Employee Loan Agreement 2014-2024 free printable template

Show details

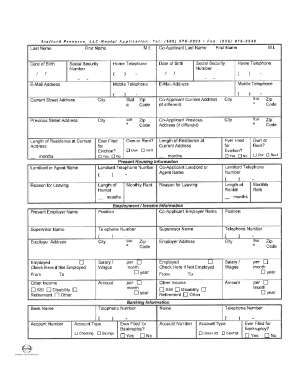

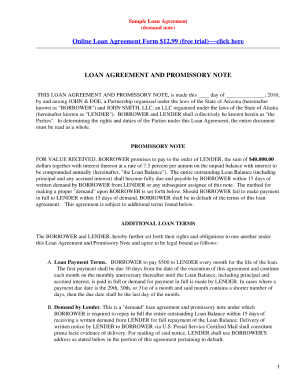

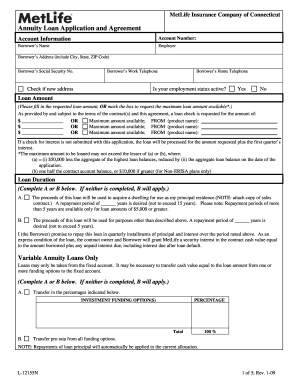

Employee Loan Agreement This Employee Loan Agreement and Promissory Note the Agreement is made and effective this day of 20 Between COMPANY NAME The Company a corporation organized and existing under the laws of the state of STATE with its head office located at STREET CITY STATE ZIP CODE AND EMPLOYEE NAME The Employee an individual with its main address at STREET CITY STATE ZIP CODE WHEREAS Employee has requested a loan from Company for personal reasons NOW THEREFORE in consideration of the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your employee loan agreement template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee loan agreement template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee loan agreement template word online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employee loan agreement form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out employee loan agreement template

How to fill out employee loan agreement?

01

Gather all necessary information: Before filling out the employee loan agreement, make sure you have all the required information such as the employee's full name, contact information, employment details, loan amount, repayment terms, and any applicable interest rates or penalties.

02

Consult with legal experts: It is advisable to consult with legal experts, such as an attorney or HR professional, to ensure that the employee loan agreement complies with all relevant laws and regulations. They can also provide guidance on any specific clauses or provisions that should be included.

03

Include essential details: Begin by filling in the basic details like the date, the name of the lender (usually the employer), and the name of the borrower (the employee). Include the employee's job title or position within the company, as well as the starting and ending dates of their employment.

04

Specify loan terms: Clearly state the loan amount, repayment terms, and any interest rates or penalties that apply. Specify the repayment period, the frequency of payments, and the method of payment (e.g., direct deposit, check).

05

Include any specific conditions: If there are any specific conditions or requirements associated with the loan, such as collateral or guarantors, make sure to include these in the agreement accurately.

06

Review and sign: Once the filled-out loan agreement is ready, it should be reviewed by both the lender (employer) and the borrower (employee). Ensure that all parties understand the terms and conditions of the loan before signing the agreement.

Who needs employee loan agreement?

01

Employers: Employers who provide loans to their employees, whether for personal or business purposes, should use an employee loan agreement. This helps protect their interests and clearly outlines the terms and conditions of the loan.

02

Employees: Employees who are borrowing money from their employer should also request an employee loan agreement. This ensures that both parties are on the same page regarding the loan terms and protects the employee's rights.

03

HR professionals and legal experts: Human resources professionals and legal experts within an organization play a crucial role in ensuring that employee loan agreements are accurately drafted and compliant with applicable laws and regulations. They can provide guidance on the proper procedures for filling out and implementing such agreements.

Fill staff loan form template : Try Risk Free

People Also Ask about employee loan agreement template word

What are the terms of the employee loan agreement?

How do I write a basic loan agreement?

Can an employer give a loan to an employee?

Can I write my own loan agreement?

How do I write a simple loan agreement?

What makes a valid loan agreement?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employee loan agreement?

An employee loan agreement is a contract between an employer and an employee that outlines the terms and conditions of a loan provided by the employer to the employee. The loan agreement defines the loan amount, the repayment schedule, the interest rate (if any), and any other necessary details. It also includes a clause that states that the loan will be considered a taxable benefit to the employee and that the employee is responsible for any taxes due.

Who is required to file employee loan agreement?

The employer and employee are both required to sign an employee loan agreement. This document outlines the terms of the loan, including the amount, repayment terms, and interest rate. Additionally, the agreement should be signed by both parties and a witness.

What is the purpose of employee loan agreement?

The purpose of an employee loan agreement is to outline the terms and conditions of a loan between an employer and an employee. It should include details such as the amount borrowed, interest rate, repayment schedule, and other important details. This agreement is intended to protect both parties and ensure that the loan is repaid in a timely manner.

What information must be reported on employee loan agreement?

1. Names of the parties involved

2. Loan amount

3. Interest rate

4. Repayment terms

5. Late payment fees

6. Collateral, if applicable

7. Date of repayment

8. Default consequences

9. Signature of both parties

When is the deadline to file employee loan agreement in 2023?

The deadline to file an employee loan agreement in 2023 will depend on a variety of factors, such as the type of loan agreement and the location of the business. It is best to consult with an attorney or tax professional to determine the specific deadline for your particular situation.

How to fill out employee loan agreement?

To fill out an employee loan agreement, follow these steps:

1. Start by including the date at the top of the document. Write "Employee Loan Agreement" as the title.

2. Identify the parties involved. Write the name of the employer or company lending the money, as well as the name of the employee receiving the loan. Include their addresses and contact information.

3. Specify the loan amount. Clearly state the exact amount of money being lent to the employee in both words and numbers. For example, write "Five thousand dollars ($5000)".

4. Outline the loan terms. Include the interest rate, repayment schedule, and any other conditions or requirements. For instance, specify if the loan is interest-free or if interest will be charged and mention the repayment period, such as monthly installments over a specified number of months.

5. Include any late payment penalties or consequences. State the penalties that the employee may face if they fail to make timely payments. Examples may include late fees or interest rate increases.

6. Specify any collateral or security for the loan. If the loan is secured by any assets, mention them in detail. This could be any valuable property or personal belongings the employee is offering as security against the loan.

7. Include any confidentiality or non-disclosure clauses. If there are any confidential or sensitive terms associated with the loan, ensure they are mentioned here to maintain the privacy of the agreement.

8. Mention the effective date and term of the agreement. Specify when the loan agreement comes into effect and its duration. For instance, write "This agreement shall be effective from [date] until full repayment of the loan."

9. Include any additional clauses or provisions. Depending on the specific circumstances, you may need to add any other relevant clauses regarding loan processing fees, defaults, or early repayments.

10. Include a signature block for both parties. Leave space for the employer and employee to sign and date the agreement. This confirms their consent to the terms and conditions stated.

11. Have the employee loan agreement reviewed and signed by both parties involved. After completing all the necessary information, ensure that both parties read and understand the agreement before signing it.

What is the penalty for the late filing of employee loan agreement?

The penalty for late filing of an employee loan agreement may vary depending on the specific laws and regulations of the country or jurisdiction. In some cases, there may not be a specific penalty for filing late. However, if there are legal requirements or obligations for filing the agreement within a certain time frame, failure to do so may result in negative consequences.

Some potential penalties for late filing of an employee loan agreement could include:

1. Late fees: There may be a stipulated fee for late filing, which may increase proportionately the longer the agreement remains unfiled.

2. Interest or additional charges: The agreement may include provisions for charging additional interest or penalties for late filings.

3. Loss of rights or privileges: Late filing might lead to the loss of certain rights or privileges associated with the loan agreement, such as access to future loans, lower interest rates, or favorable repayment terms.

4. Legal complications: Late filing might result in legal complications or disputes between the employer and employee if either party feels their rights or obligations have been violated.

It is important to consult the specific laws and regulations in your jurisdiction or seek legal advice to determine the exact penalties for late filing of an employee loan agreement.

How do I make edits in employee loan agreement template word without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing employee loan agreement form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the employee loan agreement template form on my smartphone?

Use the pdfFiller mobile app to fill out and sign simple employee loan agreement template. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete employee loan agreement sample on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your company loan to employee agreement template form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your employee loan agreement template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Loan Agreement Template is not the form you're looking for?Search for another form here.

Keywords relevant to employee loan template form

Related to loan agreement between employer and employee

If you believe that this page should be taken down, please follow our DMCA take down process

here

.